It was the most important oil meeting in years. The world was watching closely on Sunday as 16 major oil nations met in Doha, Qatar. Saudi Arabia and Russia, two of the world’s biggest oil producers, were among the heavyweights in attendance. The purpose of the meeting: to reach an agreement to “freeze” oil production at current levels. It was the first time in fifteen years that OPEC, a cartel of 13 oil producing countries, met with nonmembers to discuss freezing output.

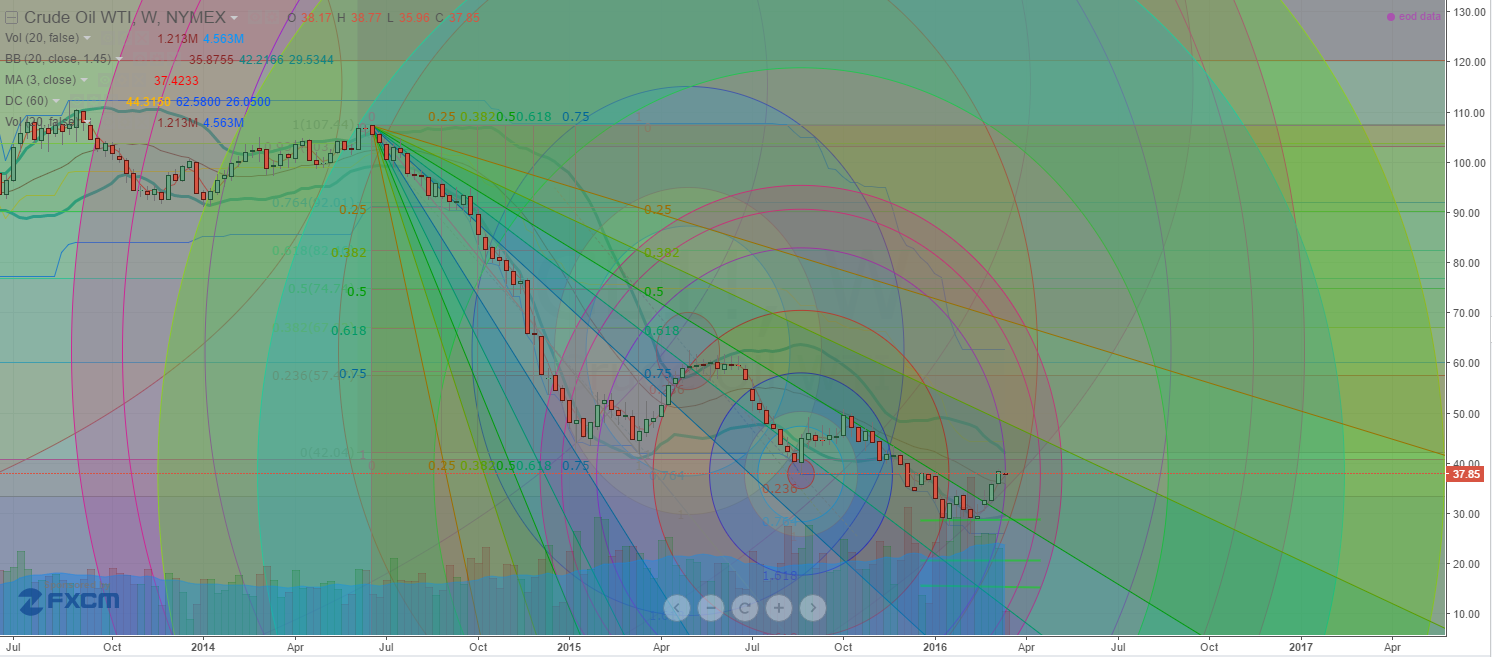

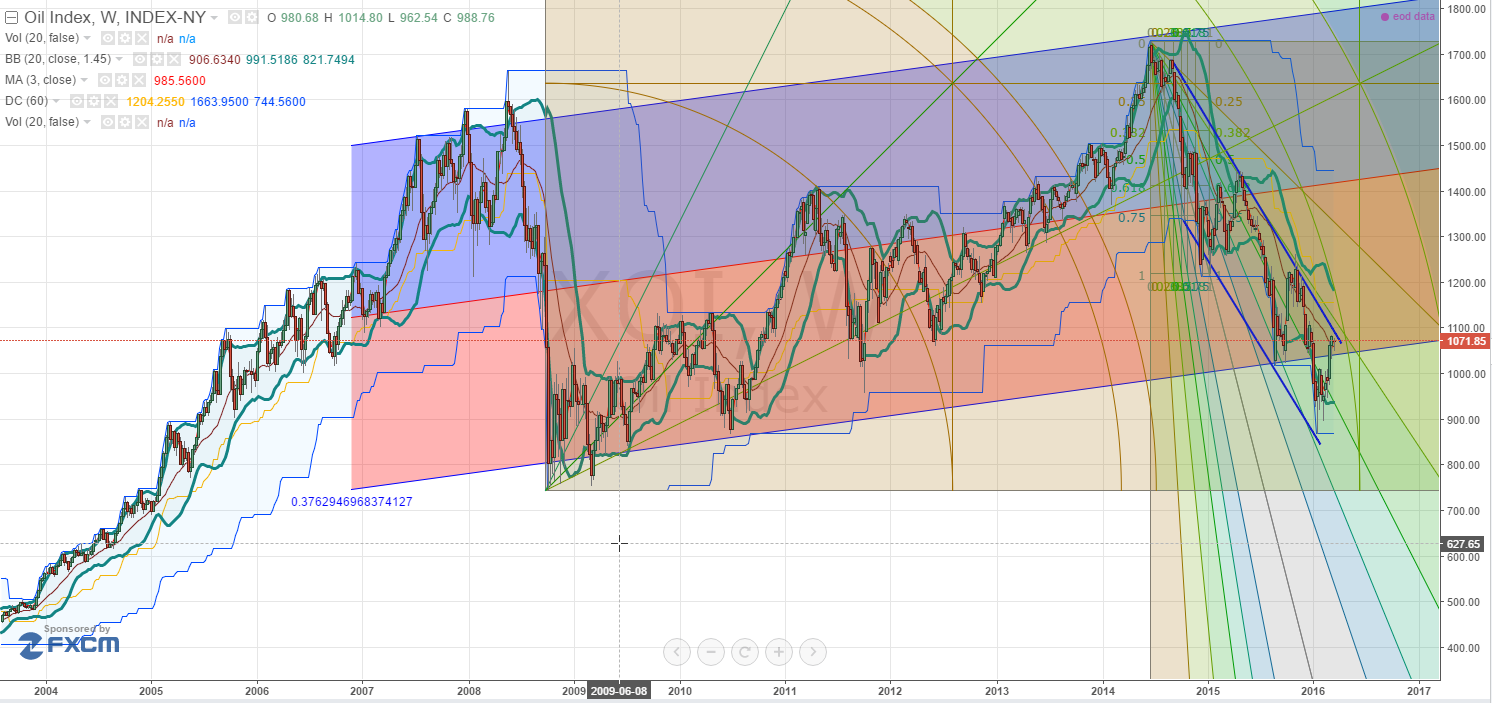

As you likely know, the price of oil has crashed 75% since June 2014. Thanks to new methods like “fracking,” the world has too much oil. According to the International Energy Association, oil companies produce about 1.4 million more barrels of oil a day than the global economy consumes.

In February, oil hits its lowest price since 2003. Low oil prices have slammed economies that depend on oil. For example, Saudi Arabia posted its largest budget deficit in history last year. And Russia’s currency has lost 49% of its value since oil prices began to decline.

Low oil prices have slammed major oil companies, too. Last year, British oil giant BP (BP) recorded its biggest annual loss ever. U.S. oil giants Exxon Mobil (XOM) and Chevron (CVX) earned their lowest annual profits since 2002 last year. Since June 2014, shares of these three oil companies are down 27% on average.

Many experts hoped an agreement to freeze production would support oil prices…

But the countries failed to reach an agreement. Bloomberg Business explained why.

Discussions broke down after Saudi Arabia and other Gulf countries rejected any deal unless all OPEC members joined including Iran…

Iran didn’t even attend the meeting in Doha…

For years, economic sanctions have cut off Iran from the global economy. These sanctions were put in place to prevent Iran from building a nuclear bomb. They crippled Iran’s economy in the process. Iran’s oil exports have plunged 45% since 2011.

The U.S. and five other countries lifted these sanctions last year. With the sanctions gone, Iran plans to significantly boost its oil production. In March, Iran pumped 3.3 million barrels per day (bpd), which made it the world’s sixth-biggest oil producer. It hopes to soon increase that to 4 million bpd.

Iran also plans to double its oil exports. In February, Iran sold oil to Europe for the first time since 2012. Bloomberg Business explains:

Iran’s oil minister called a proposal by Saudi Arabia and Russia to freeze oil production “ridiculous” as it seeks to boost output after years of sanctions constrained sales.

Yesterday, the price of oil plunged 6.4% on the bad news…

But it recovered almost all its losses, ending the day down just 0.7%. Today, it’s up 3.2% Oil stocks shrugged off the bad news, too. The SPDR S&P Oil & Gas Exploration & Production ETF (XOP), which tracks major U.S. oil producers, rose 2% yesterday. We see this as an important bullish sign for oil stocks. This bad news could have easily pushed oil below $30 a barrel. Instead, oil is trading higher today than it was yesterday.

It looks like the worst is over for oil stocks…

Although we’re not “calling the bottom” in oil stocks, we do think the oil market has entered a new phase.

You see, when an industry crashes as hard as oil has over the past 18 months, all stocks in the industry usually tank. Even the best companies suffer big losses. But when a crashing market nears a bottom, things start to change. Investors looking for bargains begin to buy top quality companies. Strong companies start to separate themselves from the weak. That’s happening in the oil sector now.

For example, Exxon, the world’s largest publicly traded oil company, has jumped 14% this year. Chevron, the second largest, has jumped 11%. These are both large, quality oil companies. Meanwhile, weaker companies are still fighting to survive. They’re bleeding cash. To make money, they need oil at $50 or higher. Yesterday, oil closed at $41.47…and that’s after a 50% rally since February. We’re not saying oil prices are ready to head higher. As we mentioned, the world is still oversupplied by about 1.4 million barrels per day. We’ll likely see more defaults and bankruptcies in the oil sector.

But we are saying now is a good time to start buying cheap, extremely high quality oil stocks…

Because oil is likely to stay low for at least several more months, it’s important to buy only the very best oil businesses. Stick with companies that have big margins, plenty of cash, and little debt. Only invest in companies that can make money even if oil stays low.

Nick Giambruno, editor of Crisis Investing, just recommended one such oil company. If you don’t know Nick, his specialty is buying quality assets for cheap, when no one else wants them. Following this strategy has allowed him to make large gains for subscribers, like the 210% gain he made on Cypriot hospitality business Lordos Hotels in the wake of that country’s banking crisis a few years back. Nick has been keeping a close eye on the oil industry for months…waiting for the right time to buy. And last month, he told his readers it was finally time to “pull the trigger.”

He recommended a world class oil company with “trophy assets” in America’s richest oil regions…a rock solid balance sheet…and some of the industry’s best profit margins. Most importantly, the company is making money. According to Nick, some of the company’s projects are profitable at as low as $35 oil.

Nick is certain this company will survive the current downturn. Its stock could deliver huge gains when oil prices recover past $50.

You can learn more about this opportunity by signing up for Crisis Investing. Click here to begin your risk-free trial.

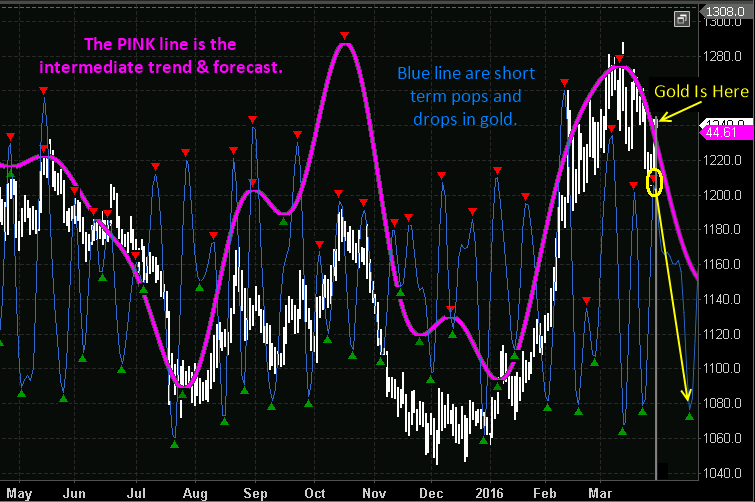

Chart of the Day

Silver is having its best day in six months. If you’ve been reading the Dispatch, you know silver recently “broke out.” More specifically, it “carved a bottom.” That happens when an asset stops falling, forms a bottom for a period of time, and starts heading higher. Assets often keep rising after carving bottoms. As you can see below, that’s exactly what silver’s done. Today, silver skyrocketed 5.3%, its biggest jump since October. Silver is now up 23% on the year. It’s at its highest price since last April.

At risk of sounding like a broken record, we think silver is headed much higher. It could easily triple in the coming years. Silver stocks, which are leveraged to the price of silver, could go even higher. If you would like to speculate on higher silver prices, we recommend you watch a short video we just put together. It explains how you could grow your money by 10x or more in the coming years. If interested, you’ll want to watch this presentation soon. It will no longer be available after tomorrow.

Click here to watch.

Get our latest FREE eBook “Understanding Options”….Just Click Here!