Eye Opening Dollar and Currency Charts

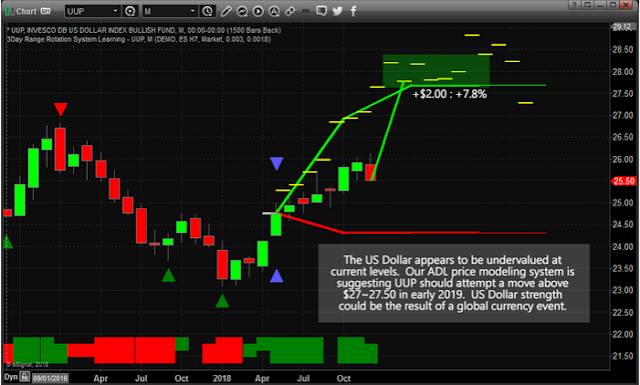

The incredible strength of the U.S. Dollar over the past 12+ months has put downward pricing pressure on Gold and Silver. I believe this downward pricing pressure could be muting any upside price advanced in Gold and Silver by as much as 20% to 30% or more.

The U.S. Dollar has turned into the global “safe haven” for international investors and foreign governments. Over the past 6 to 12 months, or more, the U.S. Dollar has been the only fiat currency to see any strength and upward trend. All the other major global currency levels have fallen – some dramatically lower.

The EUR, GBP, AUD, CAD, and CHF have all fallen sharply over the past 6 to 12 months as the strength of the US Dollar and US Economy continued to surprise many. We’ve been calling this a “capital shift” that started back in 2015~2016 – when the 2016 US Election cycle began and China began to implement capital controls. At the same time, foreign nations such as Brazil and Venezuela began to shift into an economic abyss while the UK dealt with BREXIT negotiations. All of these external factors created an environment where the U.S. Dollar became a global safe haven for global investors – all of which were seeking U.S. equities and U.S. Dollars to hedge weakening foreign currencies and weak foreign stock market performance.

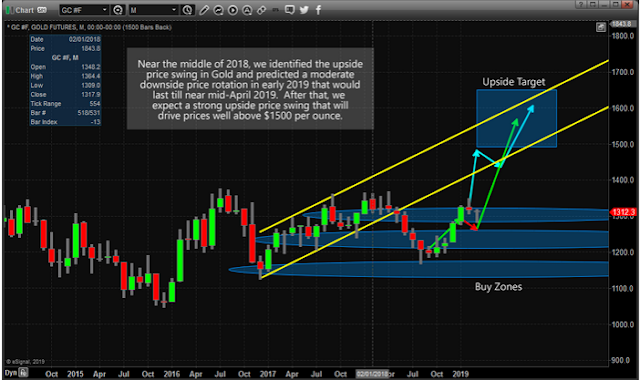

I think that the US Dollar strength, in combination with the continued foreign Gold acquisitions has amounted to a resolved “reversion” in Gold prices that could reflect a 10% to 20% price anomaly. In other words, the strength of the US Dollar has muted the advancing price of Gold by our estimates of 2x to 2.5x the strength of the US Dollar. Over the past 12 months, the US Dollar rallied from 89.42 (April 2018) to 97.92 (May 2019: current price). This reflects a 9.60% increase in the value of the US Dollar.

If my research is correct, the price of Gold should have rallied by about 18% to 26% from the April 2018 levels IF the US Dollar had not appreciated in value as it has. Therefore, the true price of Gold should be somewhere near $1600 (18% above April 2018 levels) to $1700 (26% above April 2018 levels) if we attempted to eliminate the “reversion effect” of the US Dollar strength.

We come to this conclusion by statistically analyzing the US Dollar strength after April 2018 and how Gold reacted to this strength – by falling over 12.5% from near $1350 to a level near $1170. That range of time reflected an 8% price advance in the U.S. Dollar. Thus, a ratio of 1.5 to 1 has clearly been established within that move. More recently, from August 2018 till now, the US Dollar has rallied 1.47% while the price of Gold has rallied 8.87%. The current price of Gold is -5.60% below the April 2018 price level.

If we were to assume that the rally in the U.S. Dollar deflated the price appreciation of Gold by nearly equal ratios, then we take the April 2018 price of Gold ($1350) and add the related price variances of Gold over this span (essentially reverting the price of Gold to April 2018 U.S. Dollar levels : $1350 * 1.27) and we end up with $1714.50. This reflects a greater than 30% price anomaly from the current price of Gold.

We need to ask ourselves one simple question, what would it take for Precious Metals and the global stock markets to revert back to these expected price levels? Would it be a move away from the U.S. Dollar? Would it be some shift in foreign currency valuations? Would it be a combination of factors that drive greater fear into the markets and reflect a U.S. Dollar valuation decline? In the second part of this article, I will explore some possibilities and explain why I believe we are just days or weeks away from finding out exactly what will cause this price anomaly to revert along with my proprietary gold price cycle forecast.

I just highlighted the strength of the U.S. Dollar in comparison to other foreign currencies and suggested this U.S. Dollar strength may have created a “price anomaly” setup in Precious Metals – specifically Gold. I believe a very unique setup is happening in the global markets right now and that the price of Gold is substantially undervalued compared to risks that are present throughout the global economies. I believe the strength of the U.S. Dollar has muted the upside potential of Gold by at least 20% to 30% over the past 12+ months and I believe a shift is taking place where Gold is starting to break these pricing constraints.

If the analysis is correct, I believe traders only have about 3~6+ weeks before we’ll find out why and what will cause this price anomaly to revert back to what I believe is “price normalcy”. The strength of the US Dollar, as well as the continued global “capital shift” where foreign investors are piling into the US stock market and US Dollar related investments, have continued to put incredible pricing pressures on Precious Metals. We believe this “shift” may be about to revert back to some levels of normalcy in term of Precious Metals pricing.

I believe a major Pennant/Flag formation is setting up in Gold where this price anomaly event will be resolved. This type of price anomaly reset, or reversion will prompt a massive upside price advance in Gold and Silver that will attempt to restore proper pricing levels to the Precious Metals commodities. I believe we are just weeks away from the completion of this Pennant/Flag apex/breakout event and believe the upside price targets identified align with a series of key events that are likely to unfold over the Summer months of 2019. Take a few minutes to read the recent three-part research post regarding these events and how they relate to the global stock/commodity markets here.

Our predictive modeling systems have been warning that a price advance in Gold and Silver will take place between April/May of 2019 and Aug/Sept or 2019. We are calling this the “initial upside price leg” because we believe this upside price move will be just the beginning of a much larger move higher for Precious Metals. We’ve highlighted some of the biggest concerns we currently have related to the global stock market price appreciation levels and the concerns related to the US Presidential Election cycle in precious articles – Please read them here :

- Proprietary Cycles Predict July Turning Point For Stock Market

- U.S. Election Cycle Will Create Increased Volatility

We believe it is imperative to alert all investors/traders of this event and to attempt to allow all investors/traders to plan for what may become one of the biggest global stock market swings in recent history as well as one of the biggest moves in Precious Metals in history.

My proprietary cycle analysis and trade signals are suggesting a mild price recovery in Gold will prompt moderate upside pricing pressure over the next 10-20+ days. This aligns perfectly with our Pennant/Flag formation, see the previous chart. It would be expected that Gold prices would form a moderate price support level near $1270 before moving back up to the upper Pennant price channel, near $1295. Then, price should set up the “Apex Breakout” move – which will likely be a “washout-low” price rotation (somewhere near or below $1270) with a very quick reversal to the upside – breaking $1330 and rallying much higher. This type of rotation is very common and often prompts traders to jump into short positions on the “washout-low” formation before getting clobbered on the reversal/rally. Be prepared.

Lastly, we want to alert everyone to a chart we’ve been following that could become a determining factor for the future of the global stock market levels, the U.S. Dollar and Precious Metals. The one thing we don’t want to see is a massive decline in yield in the 2 Year Treasuries. This would indicate failed growth expectations throughout the globe and, in particular, reflect concerns that the US markets could contract/decline in line with further global market devaluations.

We’ve already been trying to warn investors that the U.S. Presidential Election cycle will likely create a stalling price pattern in the US stock market. We’ve been warning, for the past 18 months, that Gold is setting up a massive bottom/breakout formation. We’ve recently highlighted the global concerns (Europe, China, US, and others) that may combine to create something like a “perfect storm” for currencies and the global equities markets. If that translates into “yield weakness” in the US Treasuries, think about how that would translate into the Precious Metals “reversion” that we are suggesting is only a few weeks away?

We strongly urge investors to pay very close attention to our research and prepare for this event. Yes, the Capital Shift event is still taking place and as long as nothing disrupts this shift, capital will continue to flow into the U.S. Dollar and U.S. Equities. Our concern is that the charts are telling us we are very near to the end of this event cycle and we are alerting all of our followers so they can prepare for this move. It may start out mildly – it may not. We do know that our predictive modeling systems are suggesting that July/August 2019 are on our radar for a major price rotation/event.

First, we typically see stocks sell off and as the old saying goes, “Sell in May and Go Away!” which is what has been happening.

So what does this mean? It means we should start to see money flow into the safe-haven assets like the Utility sector, bonds, and most importantly precious metals. I anticipated this and our XLU utilities ETF taken with members has already hit our first profit target, and our VIX ETF trade also hit out 15% profit target and we the balance of it is still up 25% as of yesterday.

Second, my birthday was this month, and I think it’s time I open the doors for a once a year opportunity for everyone to get a gift that could have some considerable value in the future.

For May I am going to give away and ship out silver rounds to anyone who buys a 1-year, or 2-year subscription to my Wealth Trading Newsletter. You can upgrade to this longer term subscription or if you are new, join one of these two plans listed below, and you will receive:

Happy May Everyone!

Chris Vermeulen